Day: 7 April 2025

Market Update March 2025

The Wholesale Electricity Market

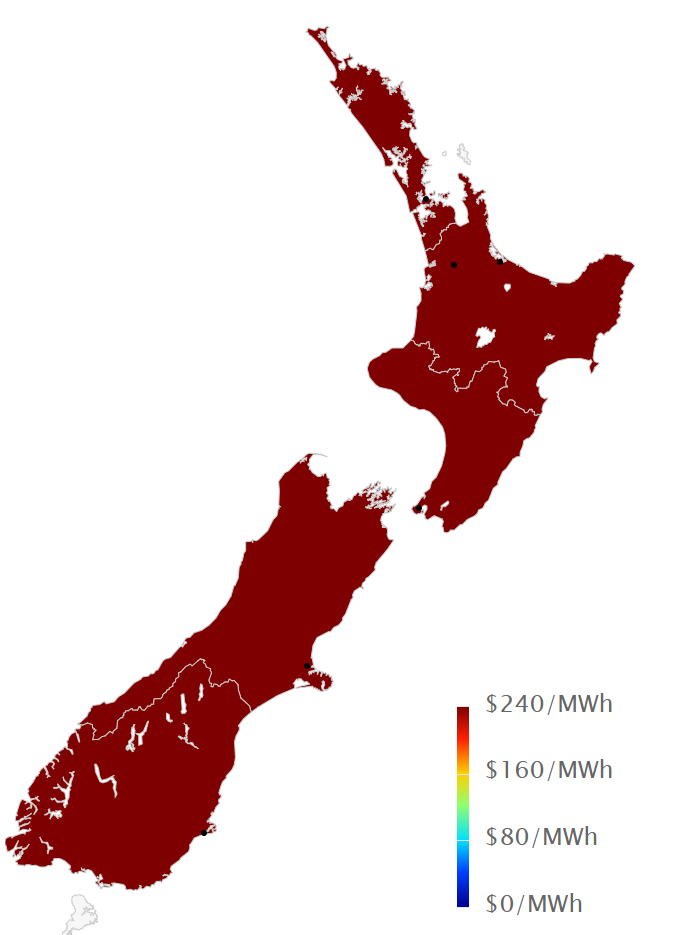

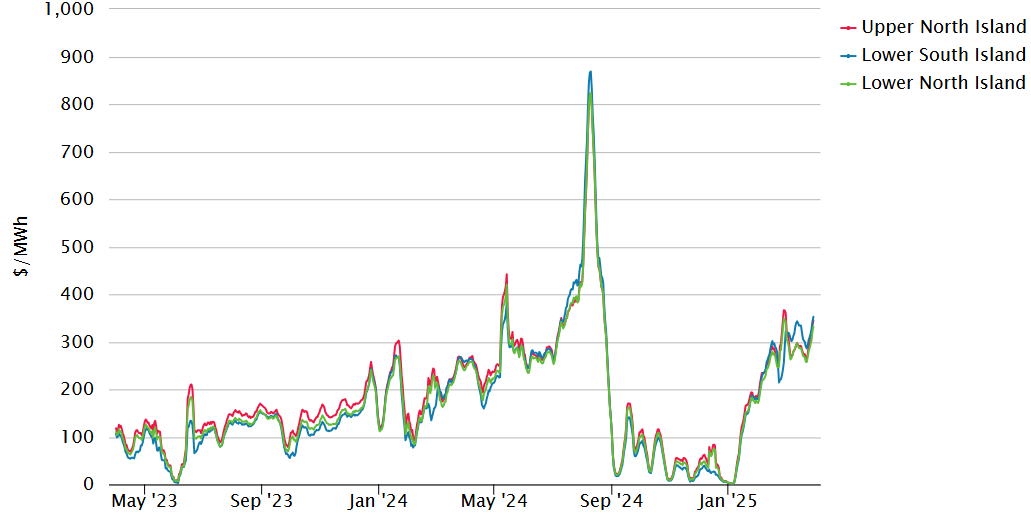

Spot prices in the wholesale electricity market for March continued to climb from February’s already very high levels. Average spot prices for the month ranged from $272 in the central North Island up to $320 in the upper South Island.

The following chart shows average weekly spot prices over the last 2 years. The large increase over the last few months can be clearly seen.

Electricity Demand

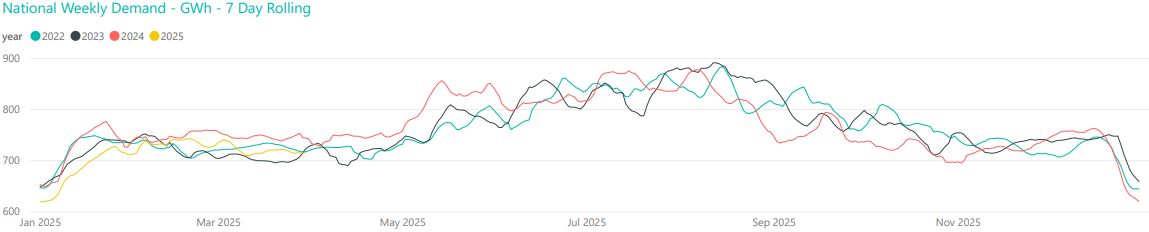

Electricity demand in March was close to average compared to what we have seen in recent years as shown below.

Electricity Generation Mix

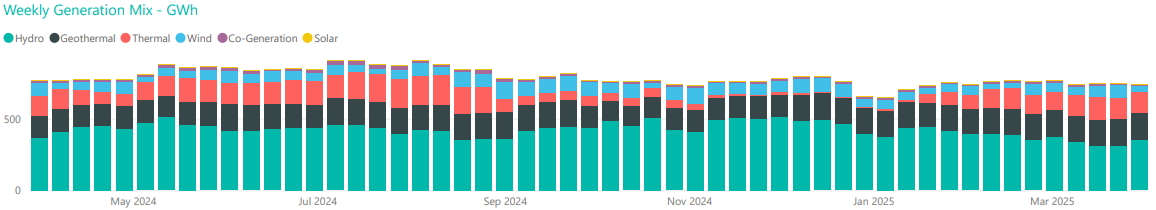

Through most of March as hydro inflows remained low and hydro storage continued to fall, dropped off, there was a continued decline in hydro generation and a corresponding increase in thermal generation. The last week of March saw some increased inflows resulting in a small uptick in hydro generation.

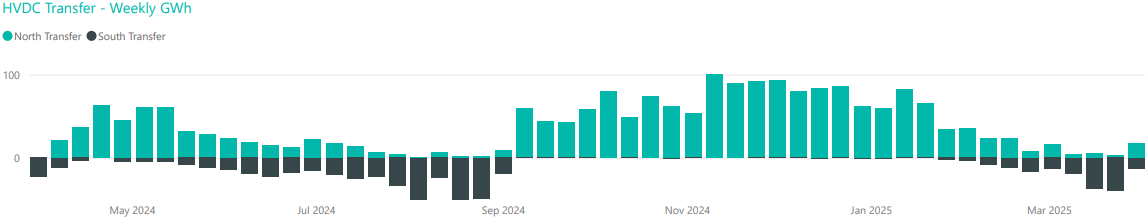

HVDC Transfer

Power transfers on the HVDC link connecting the North and South Islands are important both in showing relative hydro positions and the reliance on thermal power to meet demand. High northward flow tends to indicate a good SI hydro position, whereas the reverse indicates a heavy reliance on thermal power to make up for hydro shortages.

With declining South Island hydro storage levels, March saw increasing net southward transfer until the last week in the month when some higher SI inflows allowed some greater northward transfer.

The Electricity Futures Market

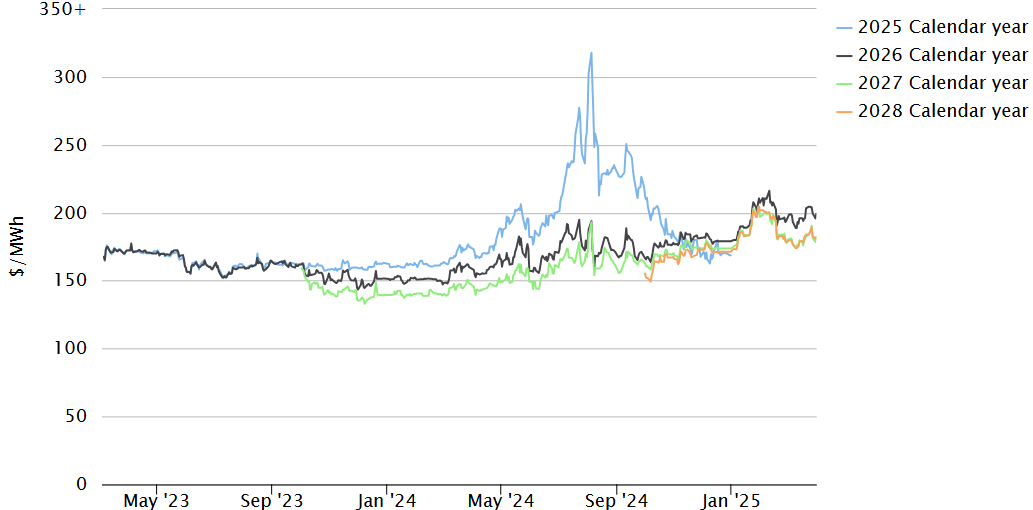

The Futures Market provides an indication of where market participants see the spot market moving in the future. They are based on actual trades between participants looking to hedge their positions (as both buyers and sellers) into the future against potential spot market volatility. They are also a useful proxy for the direction of retail contracts.

The following graph shows Futures pricing for CY 2025, 2026, 2027 and 2028 at Otahuhu (Auckland) for the last 2 years.

Note that $100/MWh equates to 10c/kWh.

Forward prices had small increases or were flat for all years through March. CAL 2026 ended the month at $196/MWh – up 1% over the month. CY 2027 price was unchanged at $179 while CY 2028 was up 1.5% at $181.

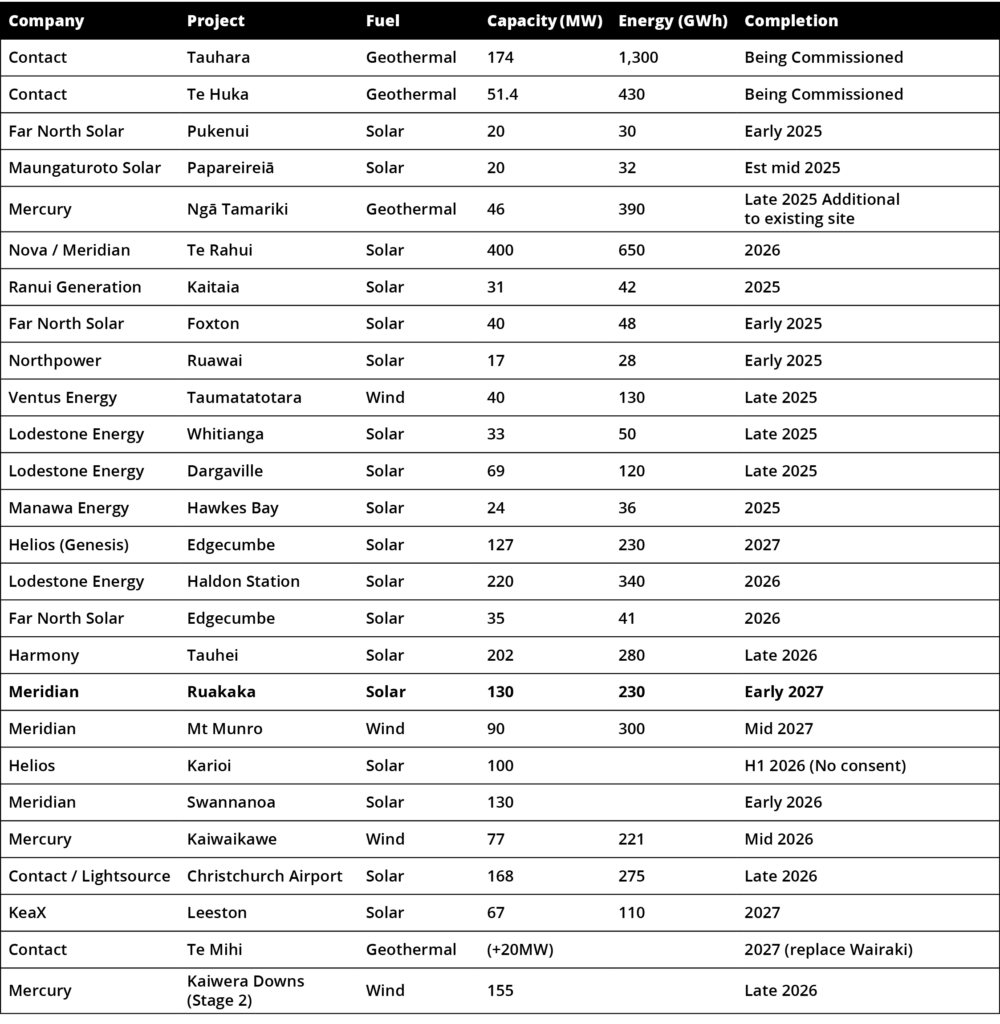

Known new generation projects are shown below (additions / removals / changes highlighted in bold).

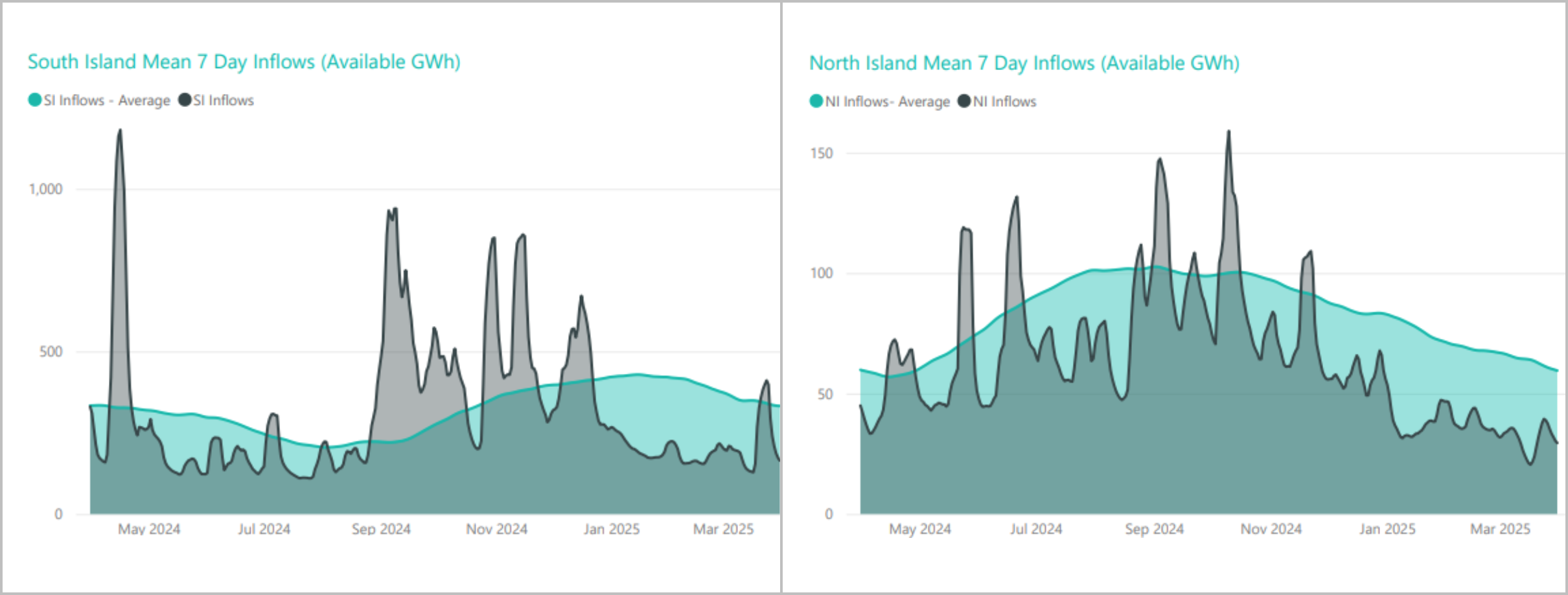

Hydro Storage

Inflows in both the North and South Islands remained well below average for most of March, though there was an uptick in SI inflows towards the end of the month.

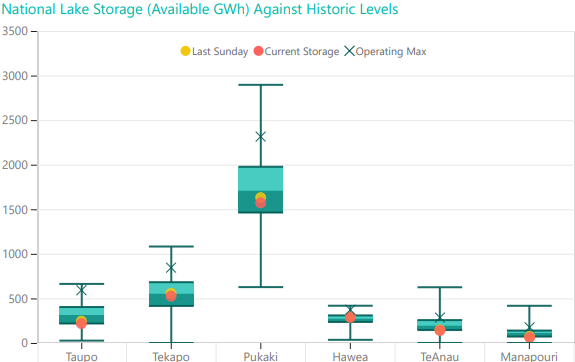

These low inflows resulted in energy storage levels falling 313GWh through the month to end at 2,675GWh (60% full). Storage remains well below the average level seen at this time of year. The following chart shows the latest breakdown of storage across the main hydro catchments.

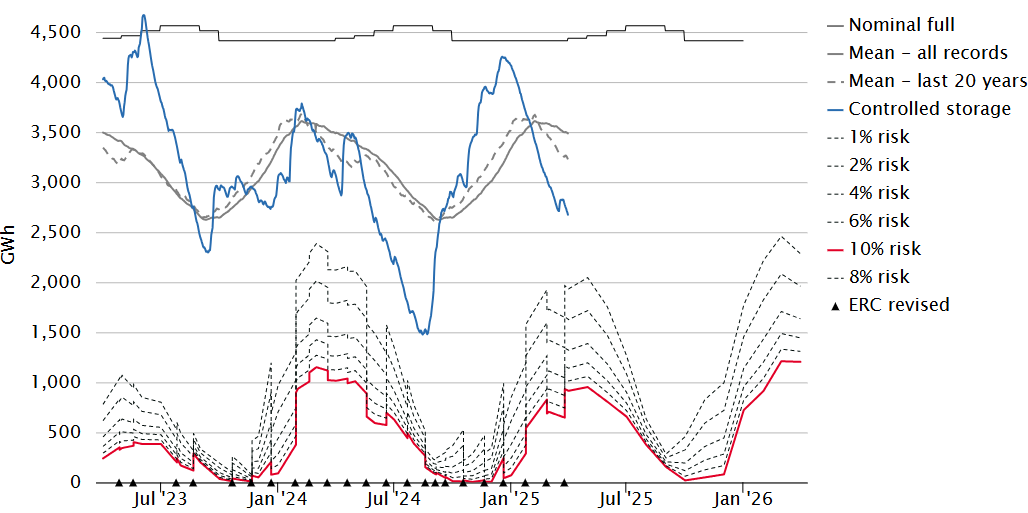

Security of supply risks increased through March with storage levels decreasing as shown below.

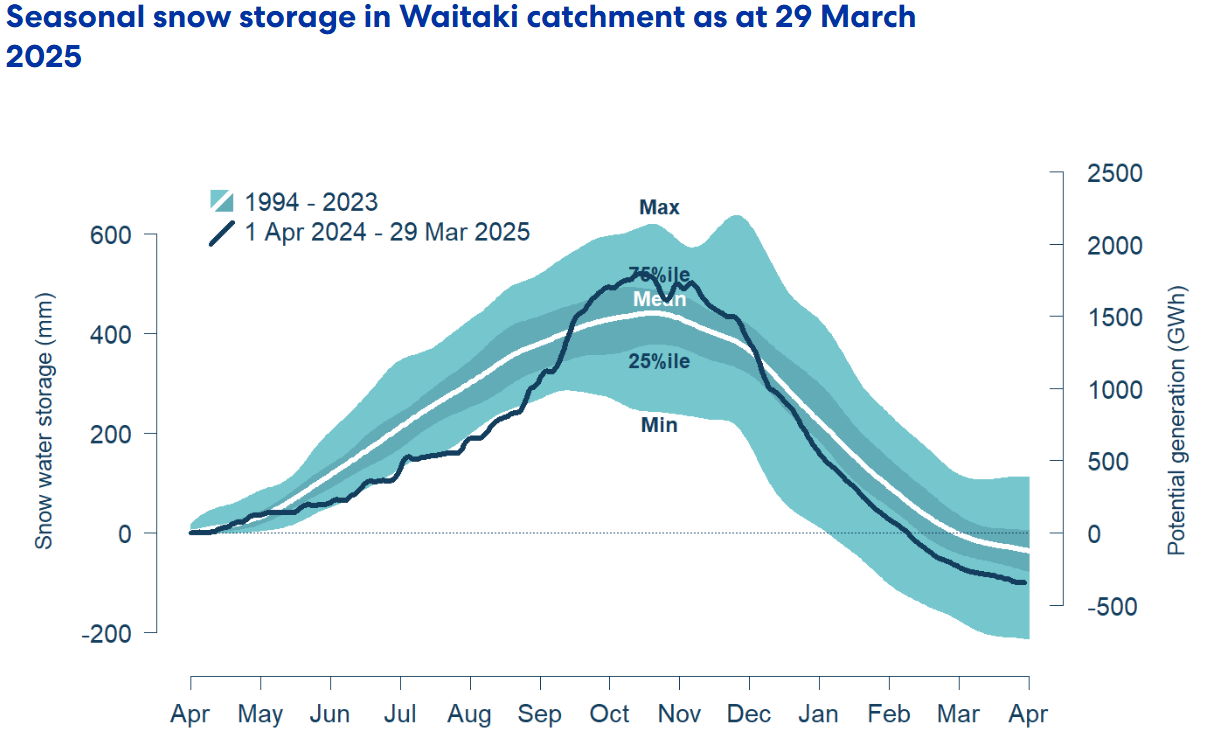

Snowpack

Snowpack is an important way that hydro energy is stored over the winter months and released as hydro inflows in the spring. The following graph shows that the snowpack in the important Waitaki catchment decreased through March, and it is currently below the 25th percentile levels seen in the last 30 years for this time of year.

Climate Outlook Overview (from the MetService)

Climate Drivers — The El Niño-Southern Oscillation (ENSO) index is now firmly at neutral levels as sea surface temperatures around the eastern Equatorial Pacific continue to warm. However, atmospheric conditions in these regions still exhibit La Niña-like traits, which may persist through much of autumn due to the typical lag in ocean-atmosphere responses.

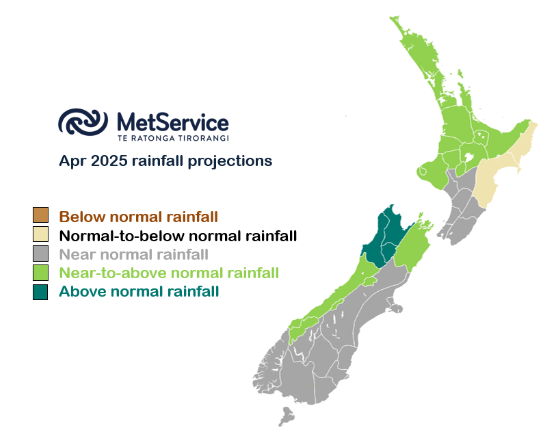

After a prolonged settled spell in March, both the Tasman Sea and Southern Ocean should see one or two unsettled bursts. The Tasman Sea Index (TSI) is trending negative (unsettled) with a low-pressure system quickly deepening to the west of New Zealand this working week. This will be followed by a burst of negative Southern Annular Mode (SAM) next week, bringing the potential for a few more cold fronts to sweep across the South Island. While both of these are expected to turn more positive again for most of the month, there are some indications of a subtropical system near mid-month to the north of the country. How this could play out remains uncertain at this stage.

An active Madden-Julian Oscillation (MJO) pulse is currently moving eastward across the western Pacific. Once it moves away, the MJO is not expected to play a major role for much of the remainder of the month.

April 2025 Outlook — As we head deeper into autumn, the weather follows suit with a shift to more unsettled conditions. A potent Tasman Sea low brings a warm and humid northerly flow with heavy rainfall to western and northern regions this week; areas that have seen little meaningful rainfall lately. The significance of this rainfall will depend on smaller-scale frontal features, but the heaviest totals and intensities may cause some issues with very dry soils, particularly for the upper South Island where the bulk of the rain should be focussed. However, for most places this is likely a very welcome return of rainfall after a dry 2025 so far.

Next week sees windy westerlies return across the South Island with brief influxes of rain in the south and west, and smaller amounts elsewhere. High pressure shifts closer to the North Island, with any systems weakening as they move northwards. Temperatures should decrease closer towards the April average, bringing some relief from the warm overnight temperatures in the North Island, although frosty mornings may become more common in the south.

While high pressure is likely to dominate again in the following days, there are hints of a subtropical northerly low nearing mid-month. While the exact track of this system (and whether it will bring another surge of meaningful rain) remain uncertain, the northern regions are most at-risk.

Late April is showing signs of unsettled weather for most places and increased chances of rainfall. Which areas have the best chance of rainfall will depend on the direction of the incoming system, but the month is looking to end much like it began, with a roar.

The Wholesale Gas Market

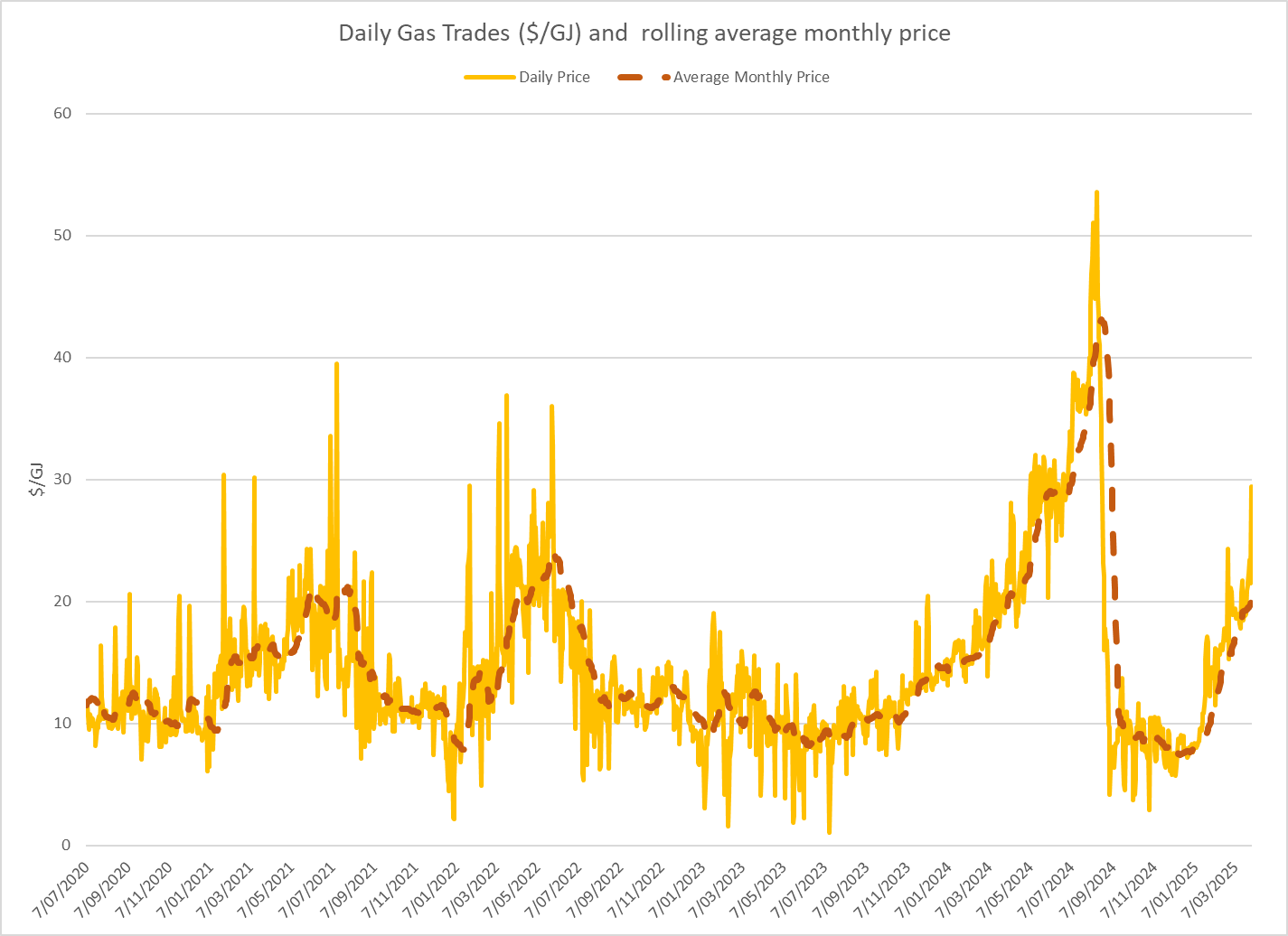

Spot gas prices in March continued to climb. Prices for the month averaged $20.2/GJ – a 27% increase compared to February. Average prices were 4% above what they were at the same time last year.

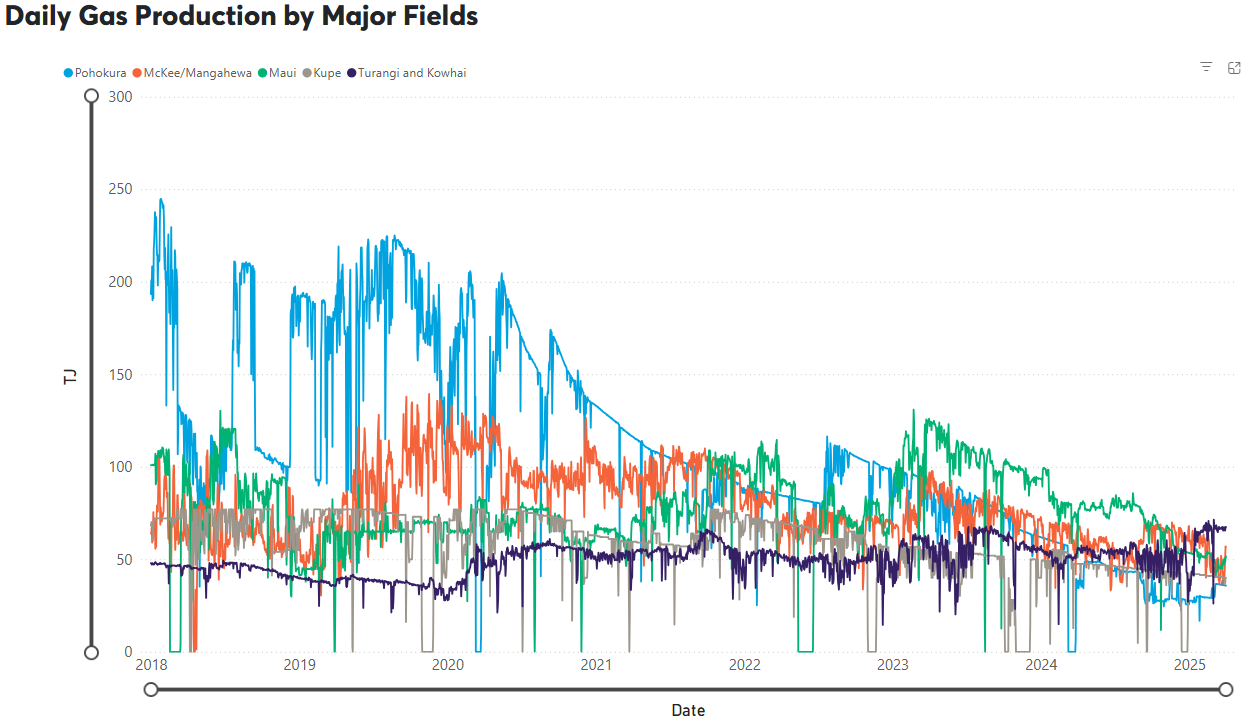

On the supply side Turangi and Kowhai maintained the higher output seen since late January, averaging 65.5TJ/day through March. Maui production reduced slightly over the month, falling below 50TJ/day. Pohokura increased output, averaging around 36TJ/day. Kupe held its output at around 41TJ/day. McKee / Mangahewa also maintained output through the month, averaging 44TJ per day.

The following graph shows production levels from major fields over the last seven years.

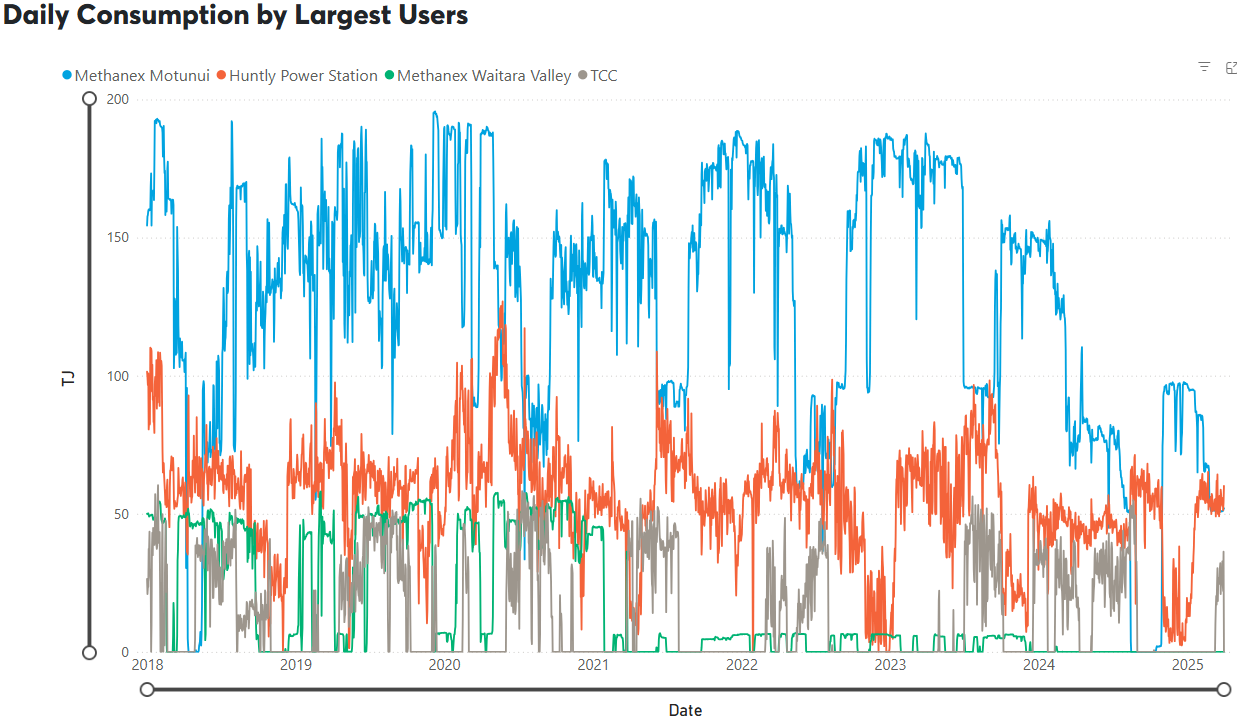

Methanex gas usage maintained the reduced level seen at the end of last month, averaging close to 50TJ/day in March. Huntly usage maintained the increased levels seen since the end of January, averaging 54TJ/day. TCC started up in early March, averaging over 25TJ/day usage by the end of the month.

The following graph shows trends in the major gas users over the last seven years.

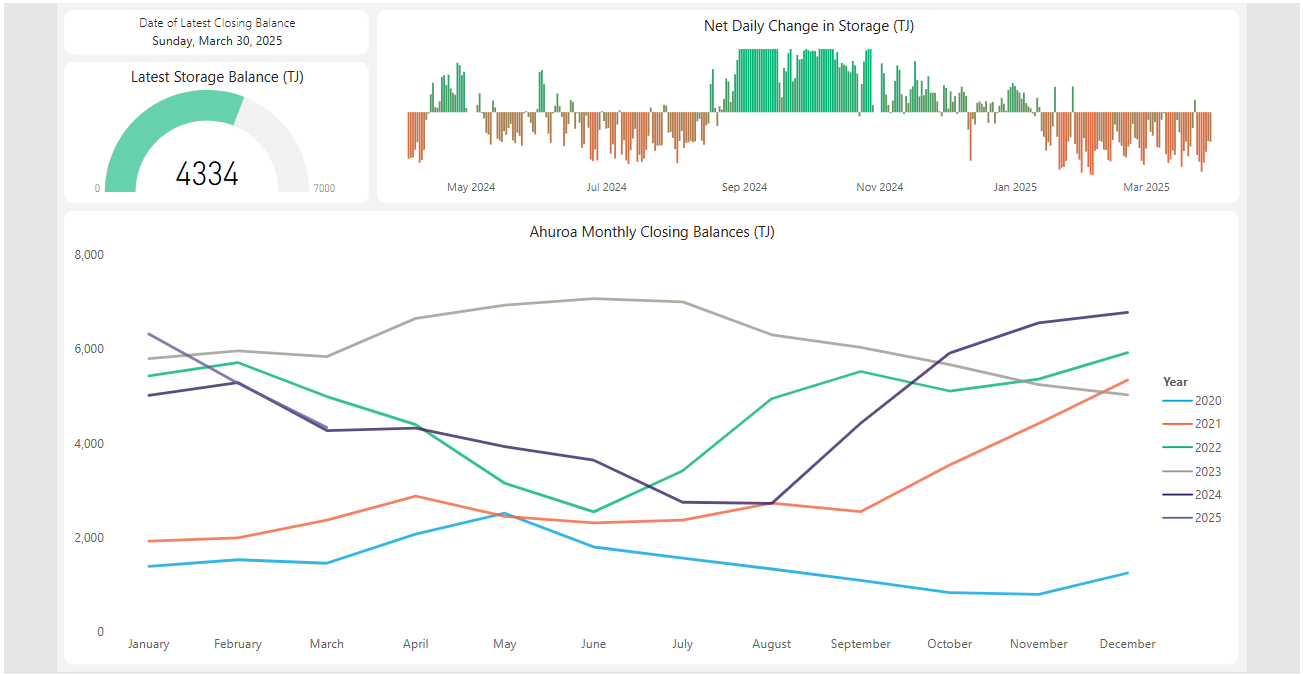

Gas storage is becoming increasingly important as falling production coincides with more variable demand, particularly from gas-fired electricity generation. The following chart shows how storage at Ahuroa decreased through March. It remains above average levels seen at this time of year over the last few years.

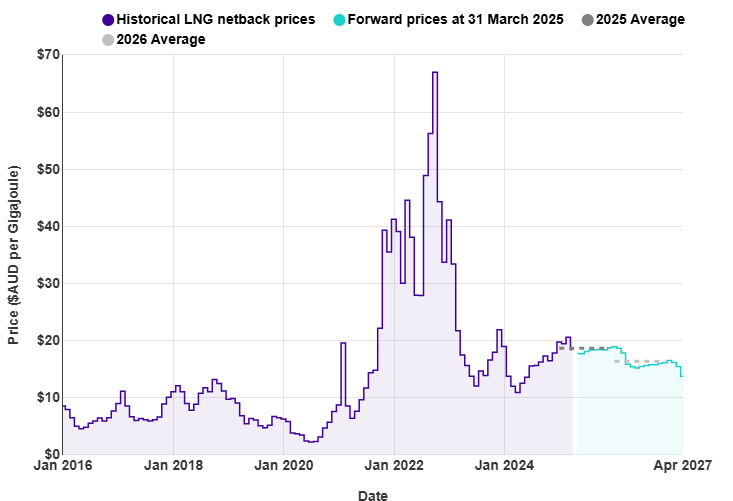

Internationally, LNG netback prices ended the month at $18.45/GJ – down 10% from last month. Forecast prices for 2025 were down 3% at $18.69/GJ. Forward prices for 2026 were up 1% at $16.41/GJ. (Note that netback prices are indicative of international prices – they are produced by the ACCC and quoted in Australian dollars. They are net of the estimated costs to convert from pipeline gas in Australia to LNG, hence the term “netback”)

New Zealand does not (yet) have an LNG export/import market, so our domestic prices are not directly linked to global prices. With recent gas supply issues, the Government is now talking about the possibility of facilitating the building of an LNG import facility.

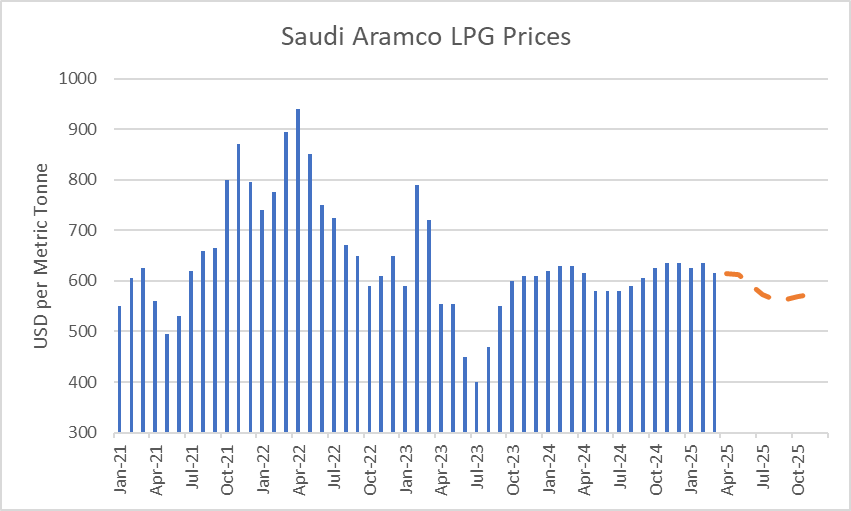

LPG is an important fuel for many large energy users, particularly in areas where reticulated natural gas is not available. The contract price of LPG is typically set by international benchmarks such as the Saudi Aramco LPG – normally quoted in US$ per metric tonne.

The following graph shows the Saudi Aramco LPG pricing for the last four years as well as forecast pricing for the year ahead. Futures pricing were up over the last month.

The other main contributing factor to LPG prices in New Zealand is the exchange rate against the USD. The exchange rate increased slightly during March to close to 0.57 but remained near the lowest levels seen in recent years. This would tend to push up LPG prices when quoted in NZD.

The Coal Market

The global energy crisis has been as much about coal as it has gas. The war in the Ukraine has driven energy prices, including coal, up. Prices in March were flat, ending the month at US$100/T. These prices are finally returning to levels close to what we expect to see as shown in the following graph of prices over the last 10 years.

Like gas, the price of coal can flow through and have an impact on the electricity market. In March, Genesis reported that it expects to import about 630,000 tonnes of coal between now and September. The company says it currently holds about 515,000 tonnes at Huntly and has plans in place to make a third dual-fuel Rankine unit there available this winter if gas supplies and lake storage remain tight. Genesis says that 500,000 tonnes is the equivalent of about 1,000GWh of electricity storage or 22% of maximum hydro storage in NZ.

Carbon Pricing

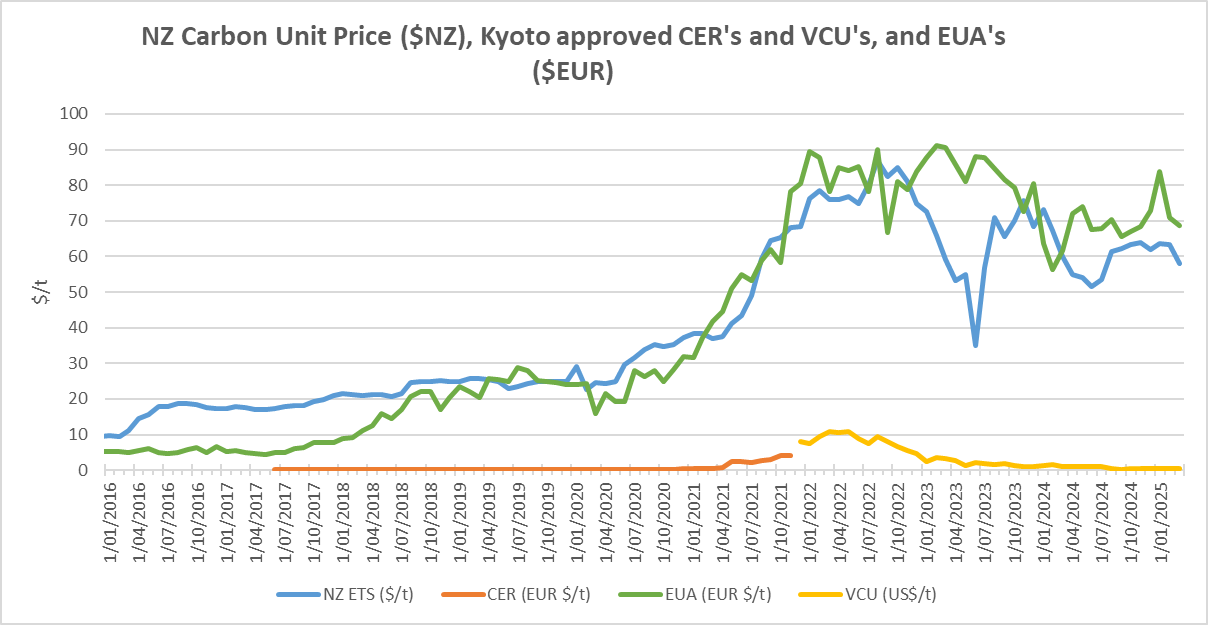

NZ has had an Emissions Trading Scheme (ETS) in place since 2008. It has been subsequently reviewed by several governments and is now an “uncapped” price scheme closely linked to international schemes. However, there are “upper and lower guard-rails” set up to prevent wild swings in carbon price that act as minimum and maximum prices. These increased in December 2023 to $173 and $64 respectively. Carbon prices decreased 8% in March to $57.9.

As the carbon price rises, the cost of coal, gas or other fossil fuels used in process heat applications will naturally also rise. Electricity prices are also affected by a rising carbon price. Electricity prices are set by the marginal producing unit – in NZ this is currently typically coal or gas or hydro generators, with the latter valuing the cost of its water against the former. An increase in carbon price can lead to an increase in electricity prices in the short to medium term (as the marginal units set the price). A carbon price of $50/t is estimated to currently add about $25/MWh (or ~2.5c/kWh) to electricity prices. In the long term, the impact should reduce as money is invested in more low-cost renewables and there is less reliance on gas and coal-fired generation.

EU Carbon units decreased in March to 69 Euro/tonne – down 3%.

About this Report:

This energy market summary report provides information on wholesale price trends within the NZ Electricity Market. Please note that all electricity prices are presented as a $ per MWh price and all carbon prices as a $ per unit price. All spot prices are published by the Electricity Authority. Futures contract prices are sourced from ASX.

Further information can be found at the locations noted below.

- Transpower publishes a range of detailed information, which can be found here: https://www.transpower.co.nz/power-system-live-data

- The Electricity Authority publishes a range of detailed information, which can be found here: https://www.emi.ea.govt.nz/

- Weather and Climate data – The MetService publishes a range of weather-related information, which can be found here: https://www.metservice.com/

Disclaimer: This document has been prepared for informational and explanatory purposes only and is not intended to be relied upon by any person. This document does not form part of any existing or future contract or agreement between us. We make no representation, assurance, or guarantee as to the accuracy of the information provided. To the maximum extent permitted by law, none of Smart Power Ltd, its related companies, directors, employees or agents accepts any liability for any loss arising from the use of this document or its contents or otherwise arising out of or in connection with it. You must not provide this document or any information contained in it to any third party without our prior consent.

About Smart Power:

Smart Power is a full-service Energy Management consultancy. Apart from Energy Procurement, Smart Power can also provide:

- Technical advice on how to reduce your energy use & emissions

- Sustainability Reporting

- Invoice Management Services

We also offer boutique energy and water billing services for landlords/property developers.

Contact us here or call one of our offices to talk to our experienced staff about how we can assist you with achieving your energy goals.

© Copyright, 2025. Smart Power Ltd