Market Update October 2024

The Wholesale Electricity Market

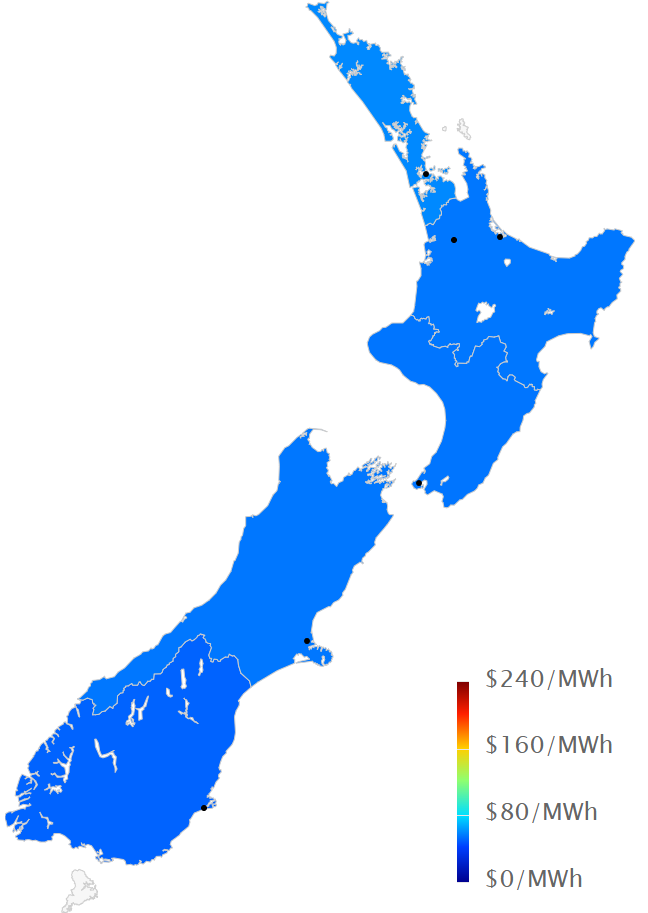

Spot prices in the wholesale electricity market for October continued at the much lower levels seen last month. Average spot prices for the month ranged from $50 in the lower South Island (down from $69 in September), up to $60 in the upper North Island (down from $80).

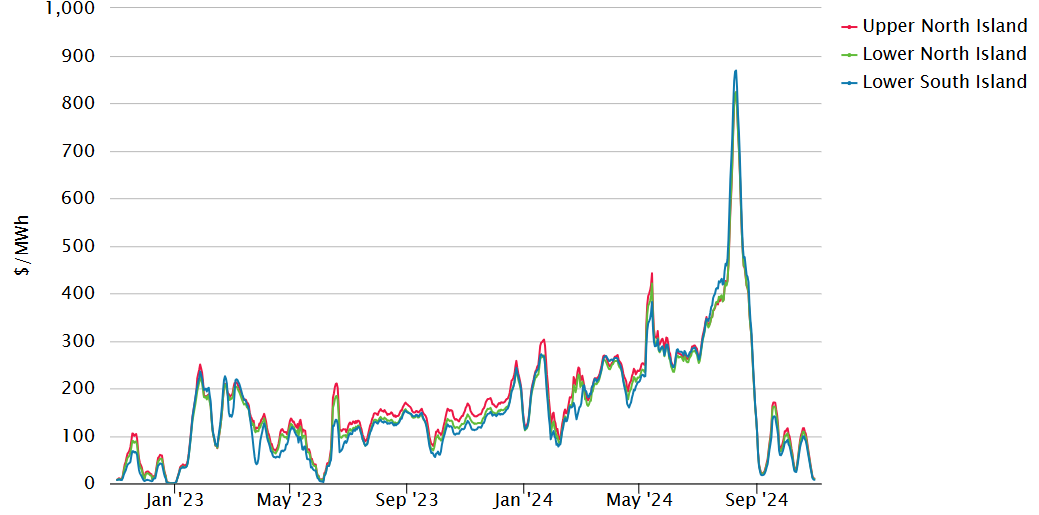

The following chart shows average weekly spot prices over the last 2 years. The extreme highs and lows over the last few months can be clearly seen.

Electricity Demand

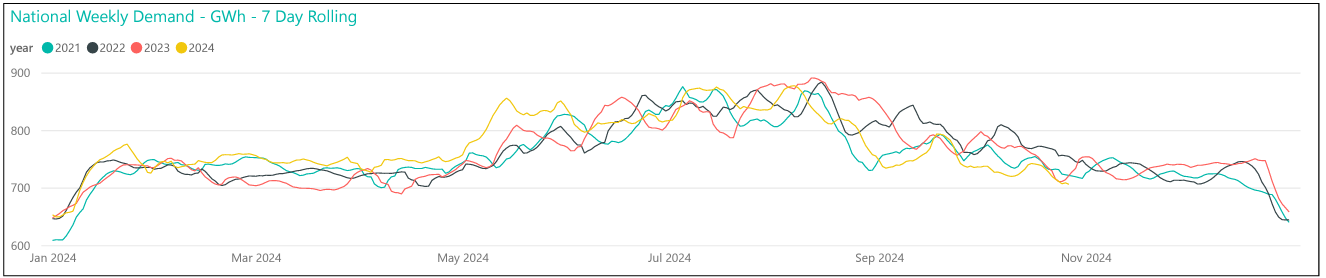

Electricity demand through October was low compared to the last few years with mild spring weather in most parts of the country.

Electricity Generation Mix

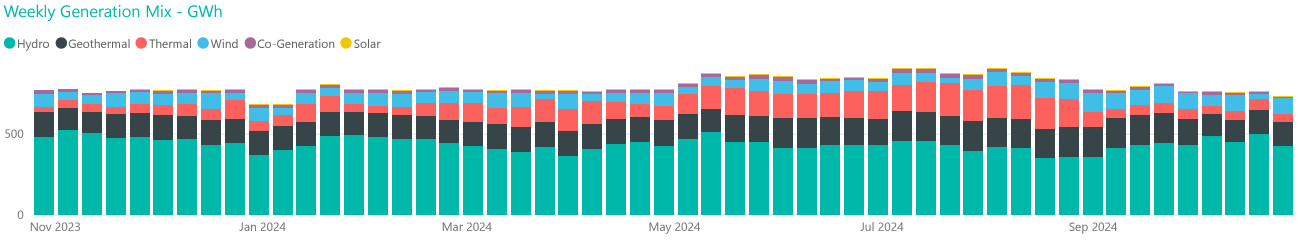

Through October, increased hydro generation meant that thermal generation could largely remain backed off.

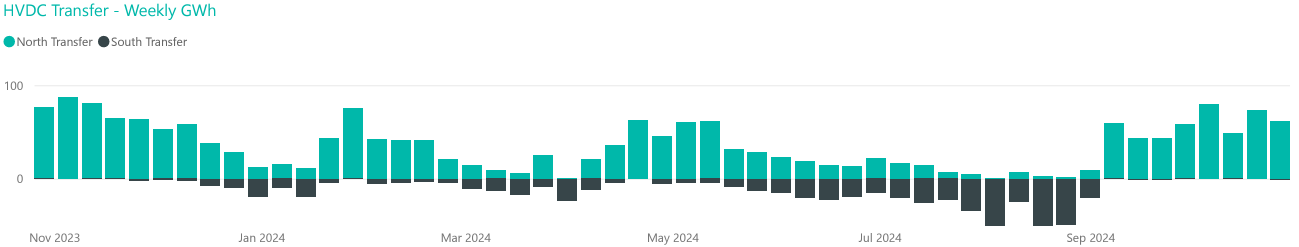

HVDC Transfer

Power transfers on the HVDC link connecting the North and South Islands are important both in showing relative hydro positions and the reliance on thermal power to meet demand. High northward flow tends to indicate a good SI hydro position, whereas the reverse indicates a heavy reliance on thermal power to make up for hydro shortages.

With plenty of uncontrolled inflows and increasing hydro storage levels, October saw continued strong northward transfers and very little southward transfer.

The Electricity Futures Market

The Futures Market provides an indication of where market participants see the spot market moving in the future. They are based on actual trades between participants looking to hedge their positions (as both buyers and sellers) into the future against potential spot market volatility. They are also a useful proxy for the direction of retail contracts.

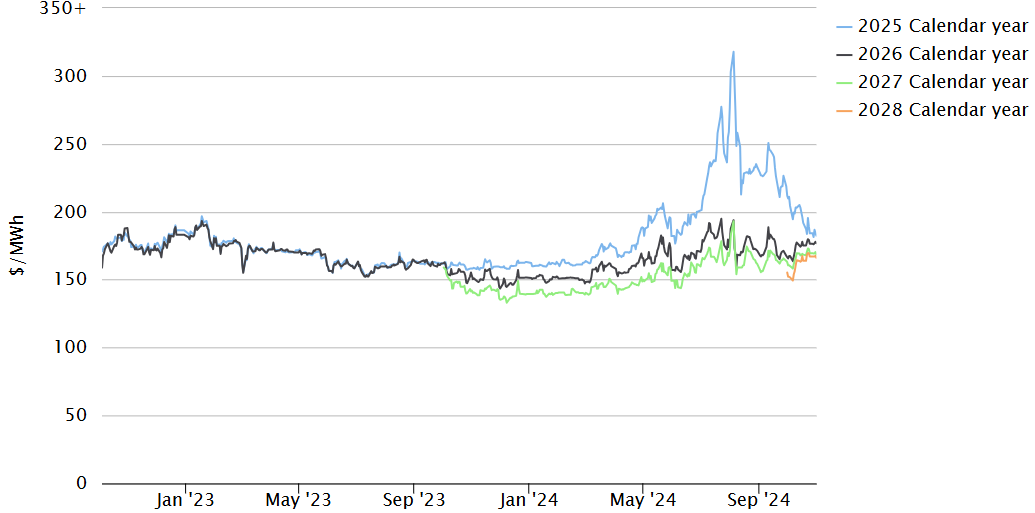

The following graph shows Futures pricing for CY 2025, 2026, 2027 and 2028 at Otahuhu (Auckland) for the last 2 years.

Note that $100/MWh equates to 10c/kWh.

Forward prices fell steeply for 2025 but increased in all other years. CAL 2025 ended the month at $184.5 – down 16%. CY 2026 price was up 6% at $178 while CY 2027 closed up 4% at $170/MWh. CY 2028 recently started being traded and is currently at $167.5/MWh.

In late October Contact hinted that TCC may remain operating through next year to support NZ’s security of supply, though it is reliant on “materially more gas being available than is currently contracted”. TCC was due to be decommissioned at the end of this year.

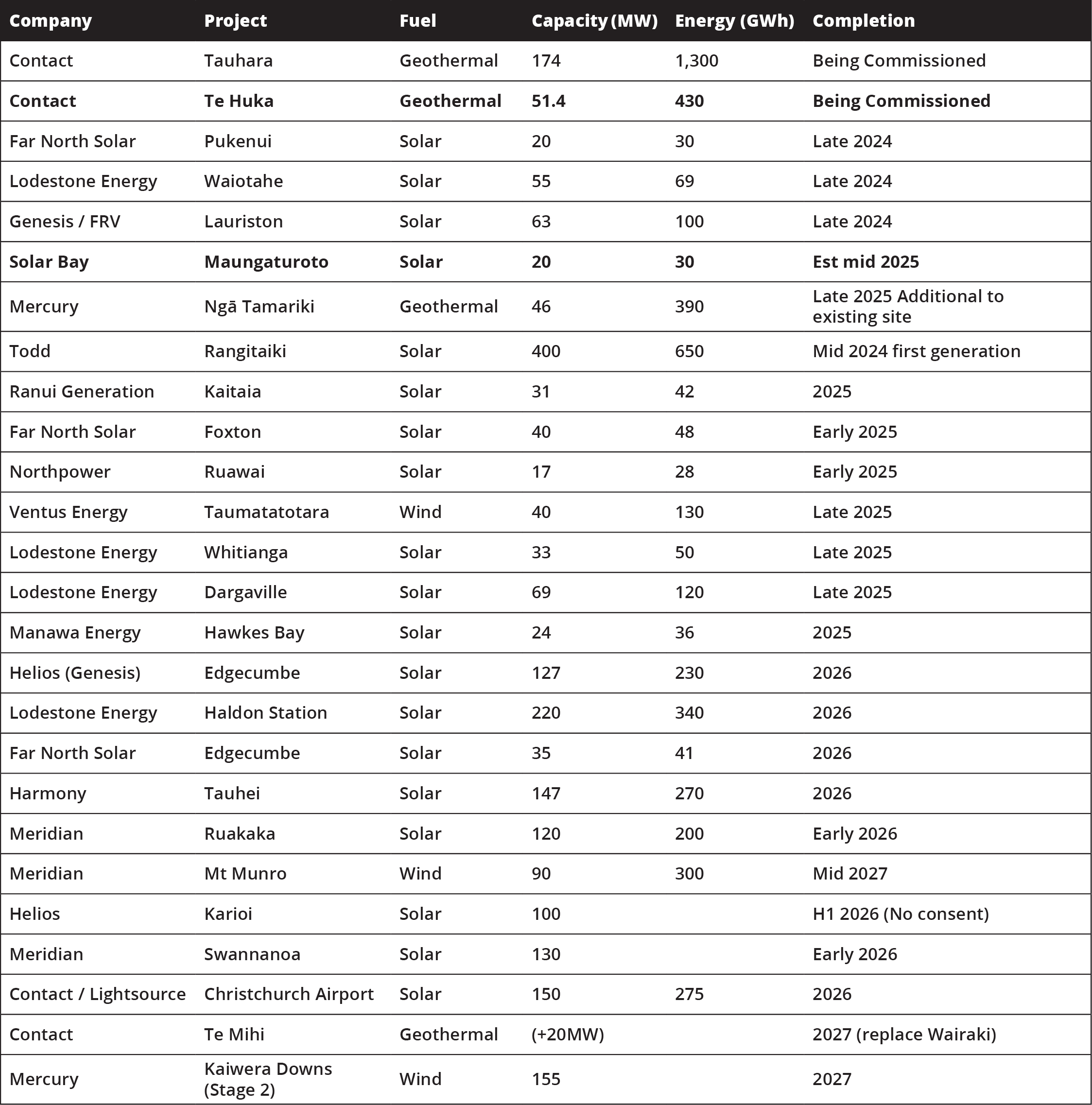

Known new generation projects are shown below (additions / removals / changes highlighted in bold).

Hydro Storage

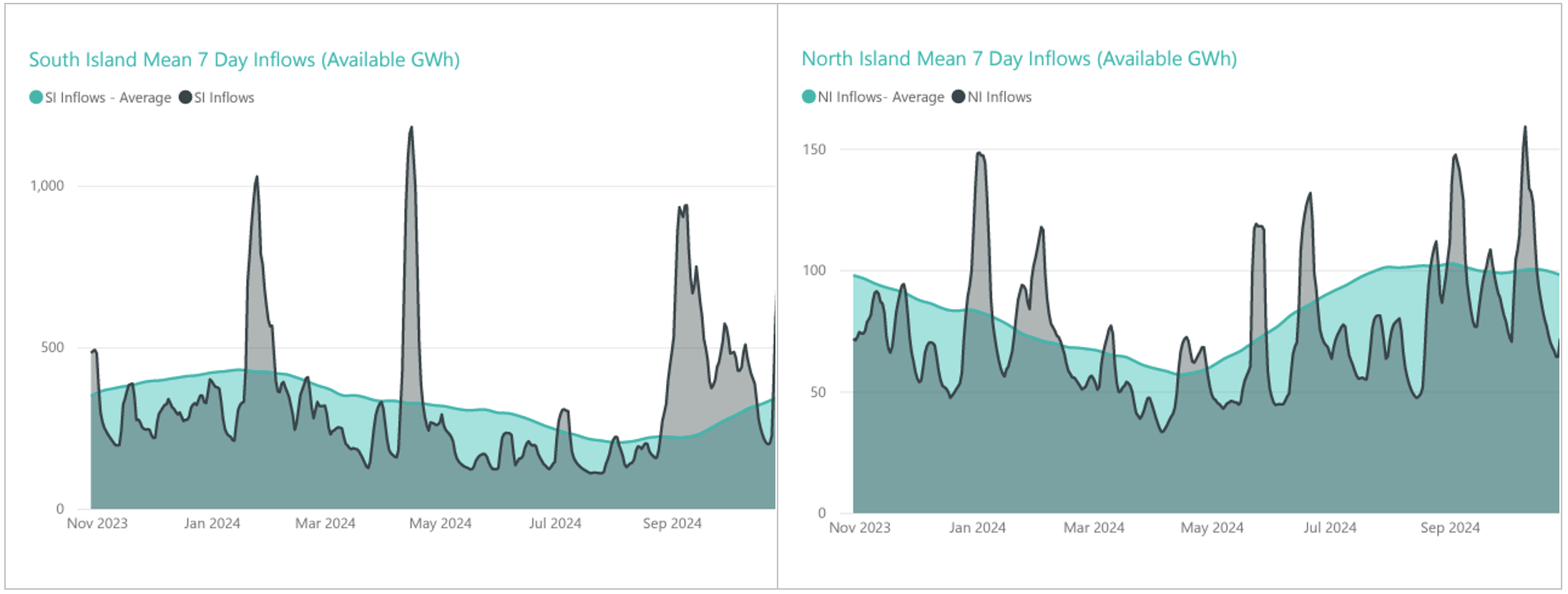

Inflows in the South Island were again well above average in October. The North Island had a little more than average inflows for the month.

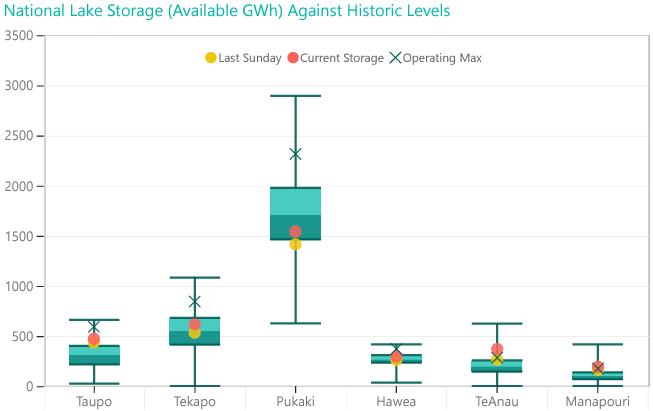

These continuing high inflows resulted in energy storage levels climbing throughout October reaching 3,411GWh (77% full) at the end of the month – an increase of 529GWh over the month. Storage is now well above the average level seen at this time of year. The following chart shows the latest breakdown of storage across the main hydro catchments.

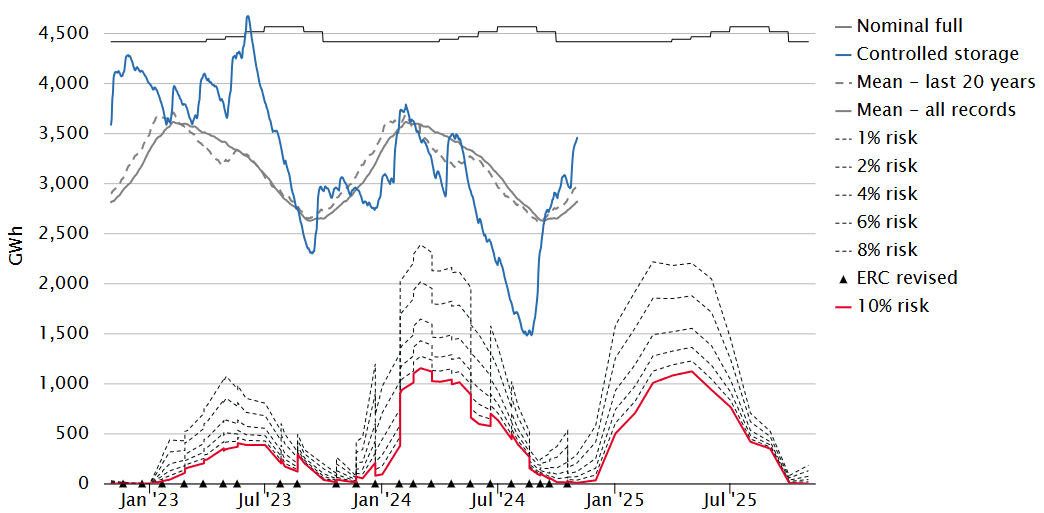

Security of supply risks decreased throughout October with storage levels increasing and Transpower making a downward adjustment in the risk curves for 2025 as shown below. This was potentially due, at least in part, to the news about TCC being available for longer.

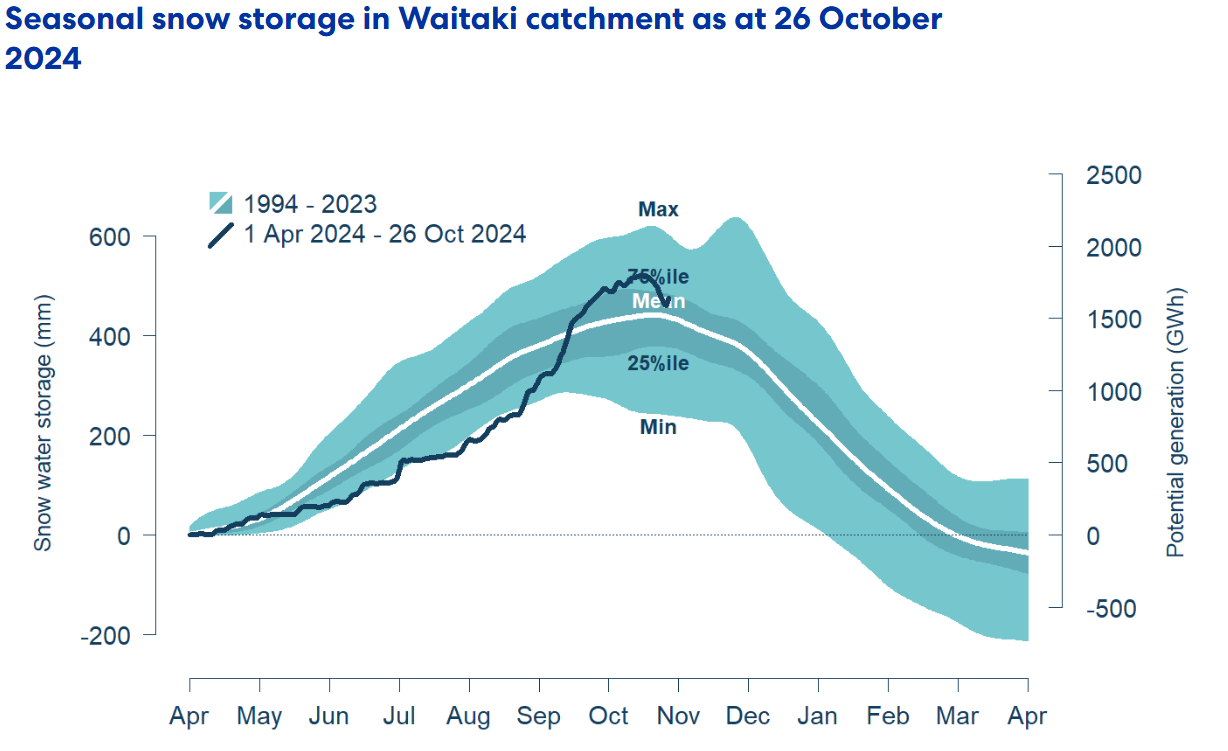

Snowpack

Snowpack is an important way that hydro energy is stored over the winter months and released as hydro inflows in the spring. The following graph shows that the snowpack in the important Waitaki catchment decreased through most of October, however remains close to the 75th percentile levels seen in the last 30 years for this time of year.

Climate outlook overview (from the MetService)

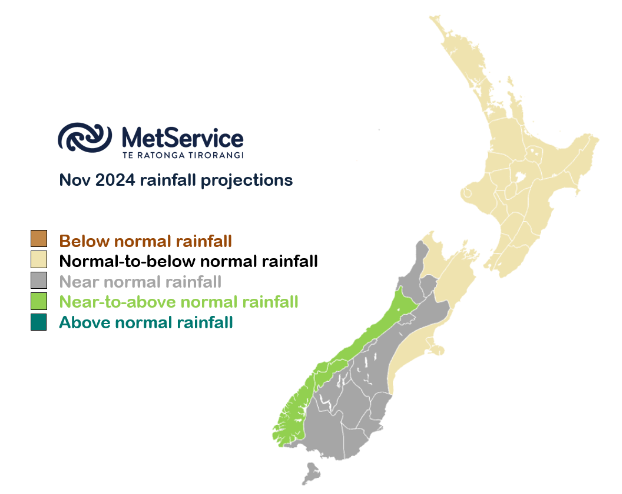

Climate drivers — New Zealand weather during most of November will be dictated by the usual short-term climate drivers, with the Southern Annular Mode (SAM) coming out of a prolonged negative (active) phase while the Tasman Sea Index (TSI) remains largely positive. This suggests that most fronts originating from the Southern Ocean should weaken as they spread further north, and more frequent high pressure systems are likely.

El Niño Southern Oscillation (ENSO) remains neutral, and while a weak La Niña may still develop over the summer, this risk has decreased slightly. However, there is now higher confidence that a negative Indian Ocean Dipole (IOD) event develops this month, which favours a more active north Tasman Sea and in turn more frequent northerly rain events for New Zealand. This is more likely towards the end of November into the start of summer, when another pulse of Madden-Julian Oscillation (MJO) moves into the Southwest Pacific.

Both the negative IOD event and MJO passage later in the month could enhance the risk for moisture-laden air masses to spread northerly rain across the top half of New Zealand. In addition, the tropical cyclone season has now begun, so any system developing north of the country may have the conditions necessary for tropical or subtropical weather systems to develop. Any northerly low in this weather setup has the potential for bringing a ‘boom-or-bust’ rain event to the country, particularly the North Island, so keep an eye to the north.

November 2024 Outlook — The start of November sees a few fronts moving onto the lower South Island while high pressure nestles over the North Island, and a short cold snap with morning frosts is possible across southern regions after frontal passages over the weekend. A warmer northerly flow then brings above normal temperatures to most of the country for the remainder of the week, with a drier weather pattern across central and northern New Zealand, while southern regions experience a slightly wetter week.

The second week of the month trends closer to average for rainfall across the board, with passing fronts followed by mobile ridges of high pressure. Temperatures become more volatile during this period, with short bouts of morning frosts intermixed with warming ridges, and the weekends cooler than average.

A solid high-pressure anomaly moves over the country from about mid-month, with many regions experiencing extended spells of fine weather. The strongest dry signal lies across the southern South Island, which also coincides with the warmest temperature pattern.

High pressure weakens and spreads eastwards towards the end of November and corresponds with a potentially more active Southwest Pacific and North Tasman Sea. While weather models are picking generally dry conditions to persist, it will become important to keep your eyes to any system approaching from the north, which have the potential to bring a ‘boom or bust’ event. It only takes one northerly rainmaker to skew rainfall totals wetter, and we can’t forget that tropical cyclone season has just begun.

The Wholesale Gas Market

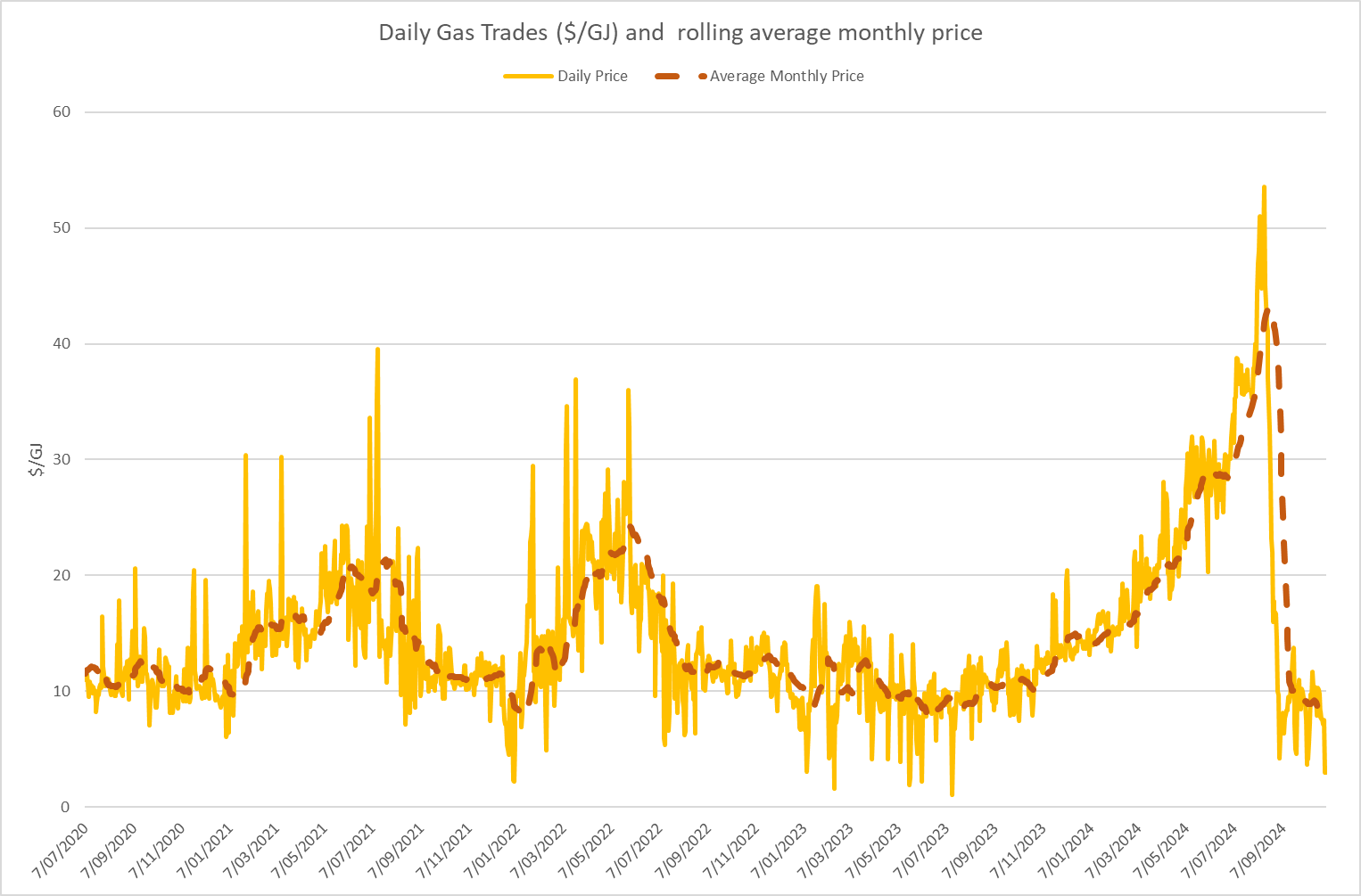

Spot gas prices in October continued at the very low levels seen in September. Prices for the month averaged $8.26/GJ – a 7% decrease compared to September. Average prices are now 22% lower than they were at the same time last year.

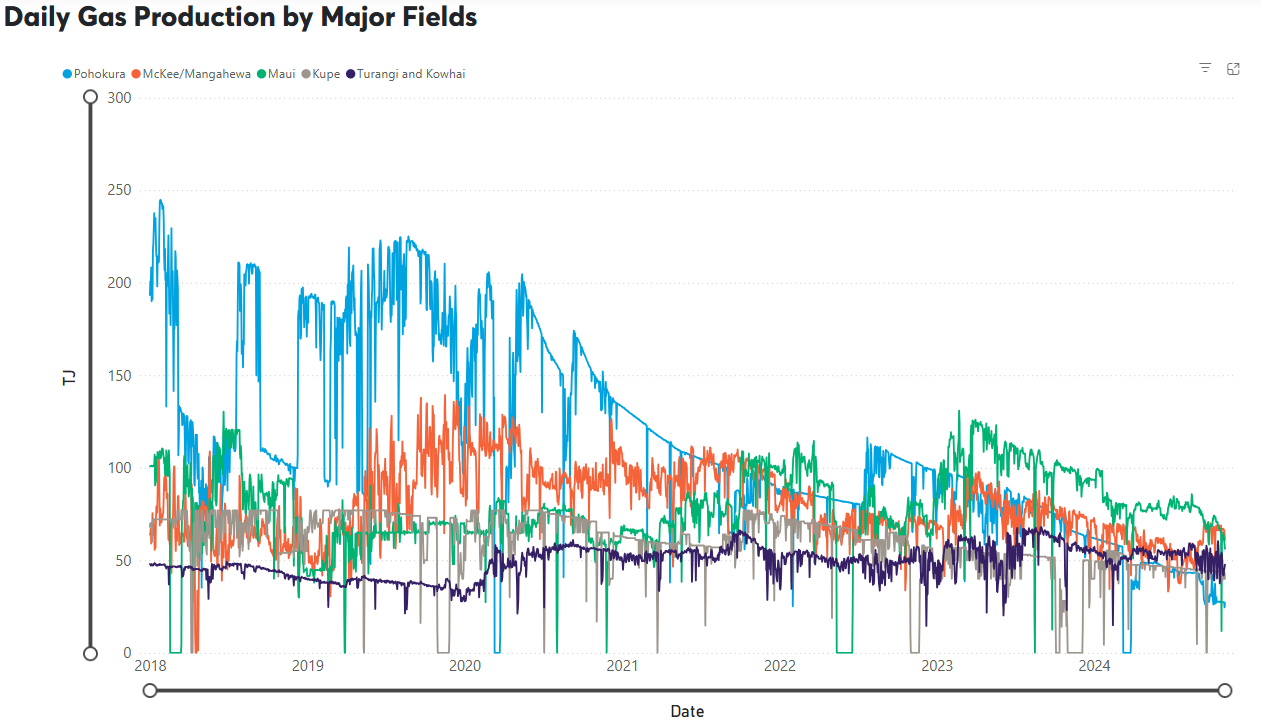

On the supply side Maui production fell through the month from 70TJ/day down to close to 60TJ/day at the end of the month. Pohokura also dropped output, averaging around 29TJ/day. Kupe decreased output from around 45TJ/day down to 40TJ/day at the end of the month. Bucking the trend, McKee / Mangahewa increased its production slightly at 66TJ/day.

The following graph shows production levels from major fields over the last 6 years.

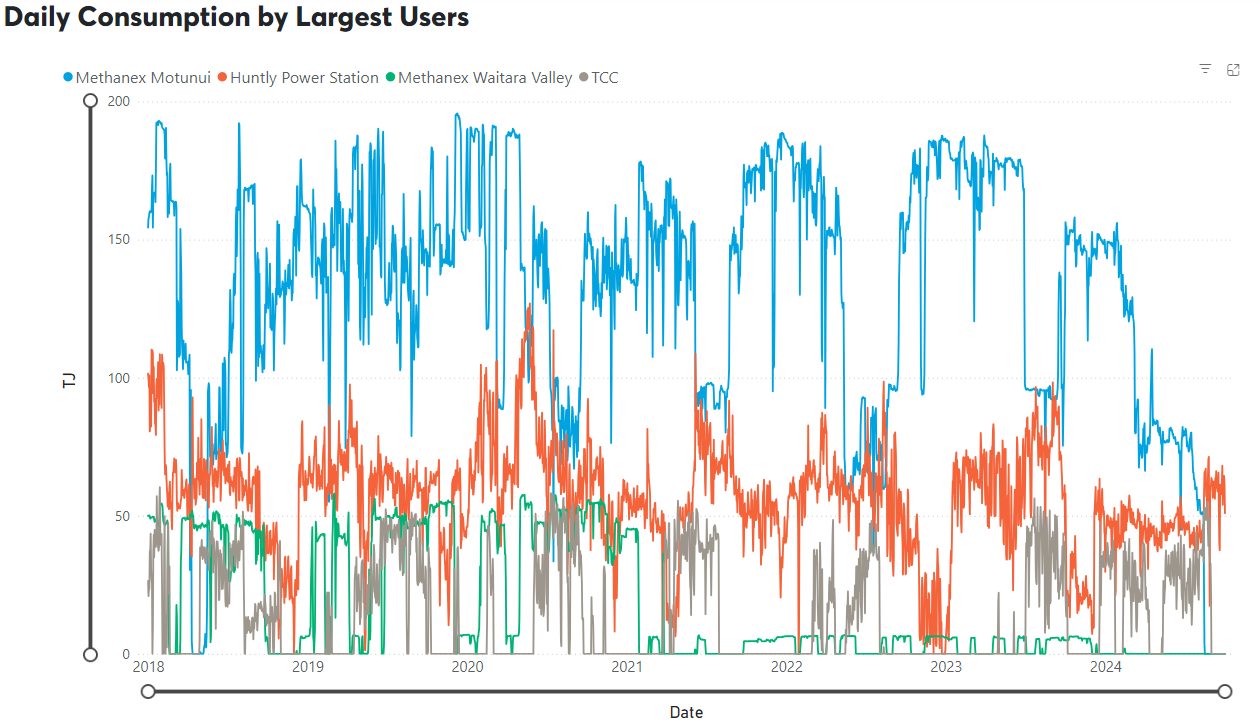

After nearly 2.5 months shutdown Methanex Motunui came back, as planned, at the very end of October. On the 31st October it used 51TJ of gas – the same level it was using just before being shut down. Huntly usage was down over the month at close to 55TJ/day, while TCC remained idle for the month.

The following graph shows trends in the major gas users over the last 6 years.

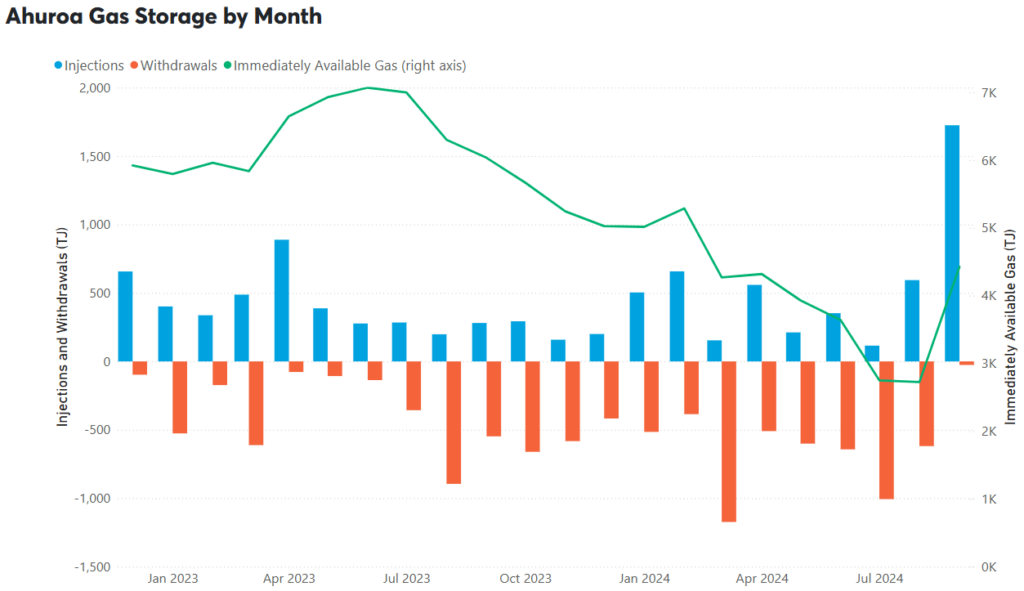

Gas storage is becoming increasingly important as falling production coincides with more variable demand, particularly from gas fired electricity generation. The following chart shows how storage at Ahuroa fell over the last 18 months, but more recently increased with Methanex shut down and increased hydro inflows limiting the need for thermal generation.

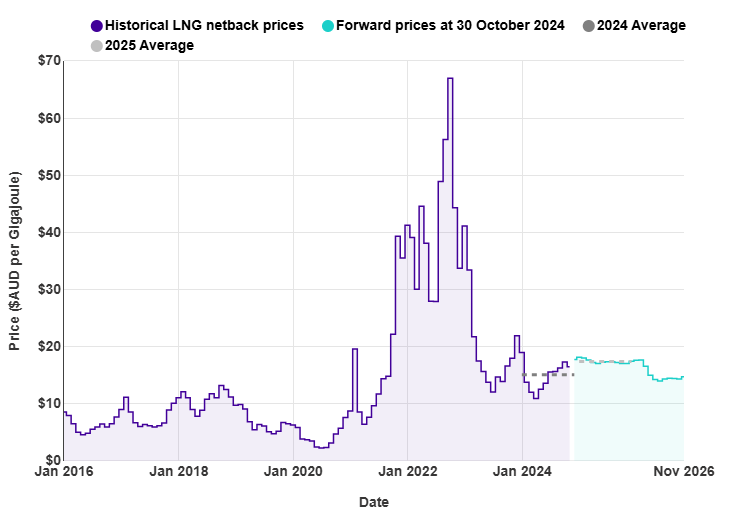

Internationally, LNG netback prices ended the month at $16.49/GJ – down 5% from last month. Forecast prices for 2024 were flat at $15.08. Forecast prices for 2025 were up 4% at $17.42/GJ. (Note that netback prices are indicative of international prices – they are produced by the ACCC and quoted in Australian dollars. They are net of the estimated costs to convert from pipeline gas in Australia to LNG, hence the term “netback”)

New Zealand does not (yet) have an LNG export/import market, so our domestic prices are not directly linked to global prices. With recent gas supply issues, the Government is now talking about the possibility of facilitating the building of an LNG import facility.

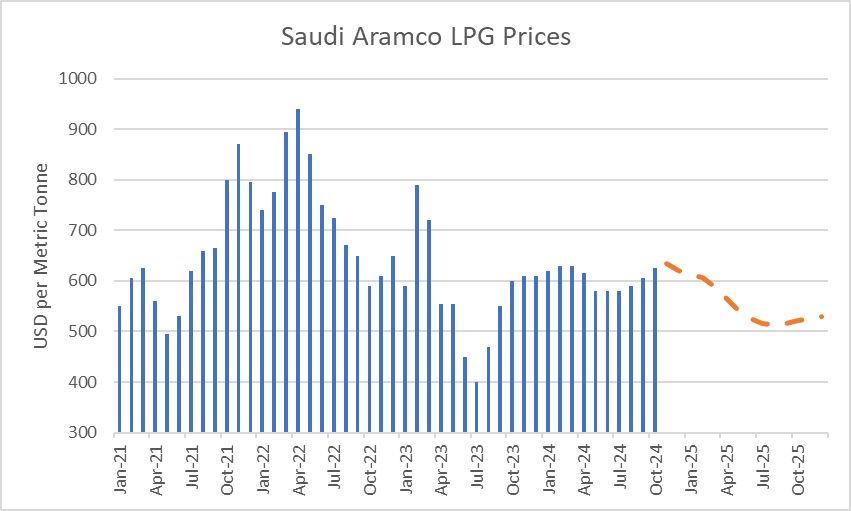

LPG is an important fuel for many large energy users, particularly in areas where reticulated natural gas is not available. The contract price of LPG is typically set by international benchmarks such as the Saudi Aramco LPG – normally quoted in US$ per metric tonne.

The following graph shows the Saudi Aramco LPG pricing for the last 3.5 years as well as forecast pricing for the year ahead. There has been a decrease in futures pricing over the last month.

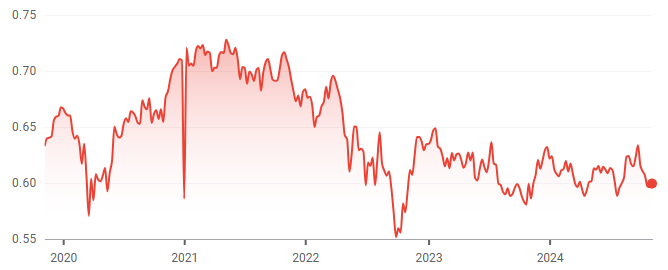

The other main contributing factor to LPG prices in New Zealand is the exchange rate against the USD. The exchange rate fell through the month ending just below 0.6. This would tend to push up LPG prices when quoted in NZD.

The Coal Market

The global energy crisis has been as much about coal as it has gas. The war in the Ukraine has driven energy prices, including coal, up. Prices in October were largely flat, ending the month at US$142/T – a 2% decrease on the September close. These prices are finally returning to levels close to what we expect to see as shown in the following graph of prices over the last 10 years.

Like gas, the price of coal can flow through and have an impact on the electricity market. In October Genesis reported that it planned to import at least 270,000 tonnes of coal by March to help secure electricity supplies going into next winter. It had previously aimed to stockpile 350,000 tonnes, but now says it wants to hold about 500,000 tonnes to cover peak autumn and winter electricity demand in 2025. Genesis says that 500,000 tonnes is the equivalent of about 1,000GWh of electricity storage or 22% of maximum hydro storage in NZ.

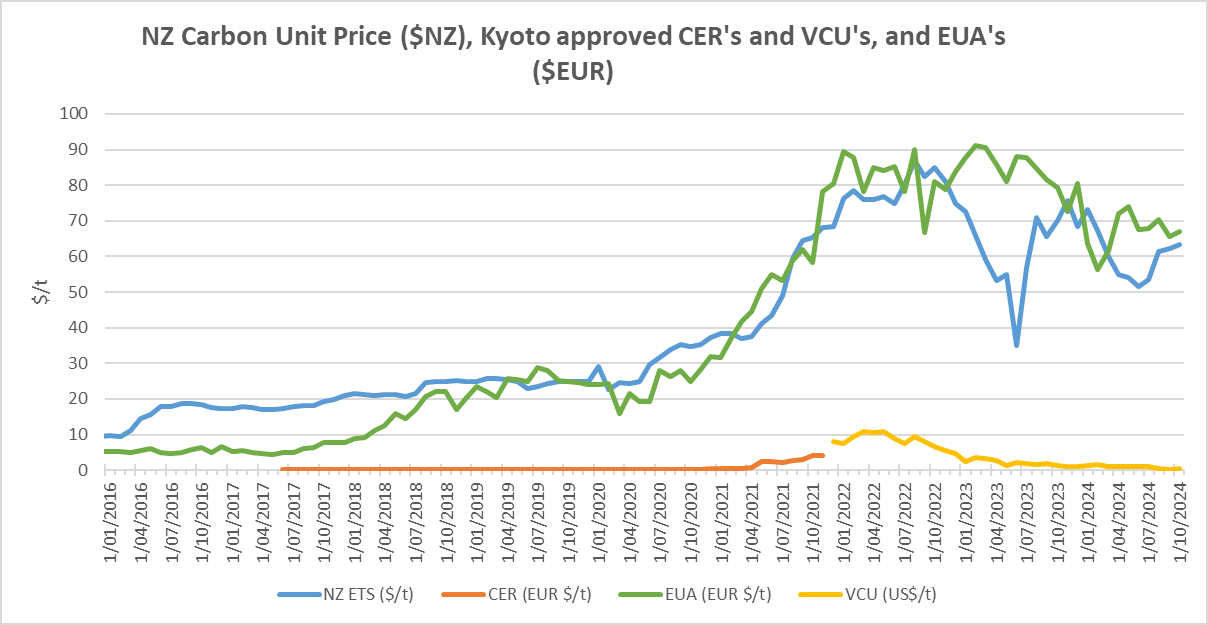

Carbon Pricing

NZ has had an Emissions Trading Scheme (ETS) in place since 2008. It has been subsequently reviewed by several governments and is now an “uncapped” price scheme closely linked to international schemes. However, there are “upper and lower guard-rails” set up to prevent wild swings in carbon price that act as minimum and maximum prices. These increased in December 2023 to $173 and $64 respectively. Carbon prices increased 2% in October to $63.4.

As the carbon price rises, the cost of coal, gas or other fossil fuels used in process heat applications will naturally also rise. Electricity prices are also affected by a rising carbon price. Electricity prices are set by the marginal producing unit – in NZ this is currently typically coal or gas or hydro generators, with the latter valuing the cost of its water against the former. An increase in carbon price can lead to an increase in electricity prices in the short to medium term (as the marginal units set the price). A carbon price of $50/t is estimated to currently add about $25/MWh (or ~2.5c/kWh) to electricity prices. In the long term the impact should reduce as money is invested in more low-cost renewables and there is less reliance on gas and coal fired generation.

EU Carbon Permits increased in October to 67 Euro/tonne – up 2%.

About this Report:

This energy market summary report provides information on wholesale price trends within the NZ Electricity Market.

Please note that all electricity prices are presented as a $ per MWh price and all carbon prices as a $ per unit price.

All spot prices are published by the Electricity Authority. Futures contract prices are sourced from ASX.

Further information can be found at the locations noted below.

- Transpower publishes a range of detailed information which can be found here: https://www.transpower.co.nz/power-system-live-data

- The Electricity Authority publishes a range of detailed information which can be found here: https://www.emi.ea.govt.nz/

- Weather and Climate data – The MetService publishes a range of weather-related information which can be found here: https://www.metservice.com/

Disclaimer: This document has been prepared for information and explanatory purposes only and is not intended to be relied upon by any person. This document does not form part of any existing or future contract or agreement between us. We make no representation, assurance, or guarantee as to the accuracy of the information provided. To the maximum extent permitted by law, none of Smart Power Ltd, its related companies, directors, employees or agents accepts any liability for any loss arising from the use of this document or its contents or otherwise arising out or, or in connection with it. You must not provide this document or any information contained in it to any third party without our prior consent.

About Smart Power:

Smart Power is a full-service Energy Management consultancy. Apart from Energy Procurement, Smart Power can also provide:

- Technical advice on how to reduce your energy use & emissions

- Sustainability Reporting

- Invoice Management Services

We also offer boutique energy and water billing services for landlords/property developers.

Contact us here or call one of our offices to talk to our experienced staff about how we can assist you with achieving your energy goals.

© Copyright, 2024. Smart Power Ltd